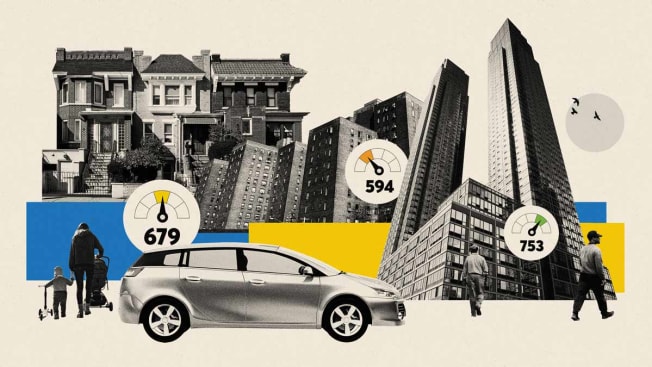

How Credit Scores and ZIP Codes Can Make Car Insurance Much More Expensive for Some New Yorkers

Drivers with poor credit are quoted more than $1,300 extra for car insurance every year, even if they have a clean record

In New York, drivers with a clean driving record but a low credit score are quoted $1,367 more for car insurance, on average, than otherwise identical drivers with excellent credit, according to a new analysis of tens of thousands of car insurance quotes.

For drivers in ZIP codes with predominantly Black residents, the gap yawns even wider: The cost of poor credit in those areas is $3,411 a year, on average.

These disparities were uncovered in a study of nearly 100,000 insurance quotes from 10 major New York car insurance companies. It was conducted by the Consumer Federation of America, a nonprofit advocacy organization.

The findings show just how much car insurance premiums can be inflated by factors that aren’t directly related to how safely a driver behaves on the road. They also reveal how a driver’s credit score can combine with their ZIP code to raise the cost of car insurance, which is mandatory for drivers in nearly every state.

“We’re talking about experienced drivers with no history of accidents or tickets facing premiums that are hundreds or sometimes thousands of dollars more, simply because of what shows up in their credit reports,” says Douglas Heller, the CFA insurance expert who led the new study. “This is unmistakably harmful to the people of New York.”

Are You Paying Too Much for Car Insurance?

Take Action: Send a letter to N.Y. lawmakers to end discrimination in car insurance.

But Brewer argues that it’s less fair to bar the use of data like credit scores, which offers a window into the likelihood of a driver filing a claim. He says that if insurers can’t predict risk using that kind of data, drivers who are less likely to file expensive claims might end up overpaying for insurance and subsidizing riskier customers.

Curbing the use of nondriving factors has long been a goal for consumer advocates, who argue that they have the potential to unfairly penalize safe drivers for circumstances beyond their control. In addition to credit reports and ZIP codes, companies often price insurance based on a driver’s education, job title, gender, and marital status.

In 2021 CR investigated two of these factors: education and job title. We found that drivers with fewer degrees or lower-paying jobs were quoted significantly higher car insurance premiums than those with more education or higher job titles.

Stacked together, these factors can create a burden for drivers. Imagine someone who works as a cashier and didn’t go to high school, has a low credit score, and lives in a ZIP code with mostly Black residents. Each one of those facts can increase their insurance premiums even though none of them has to do with how safe a driver they are.

In some cases, the price of a low credit score can be so extreme that it can even outweigh the steep penalty of a drunk-driving charge. In 2015 Consumer Reports found that a driver in Florida with a clean driving record and poor credit was charged $1,552 more than an identical driver with excellent credit and a DUI.

Advocates would rather that companies rely only on information about your behavior on the road, like past collisions and speeding tickets, along with such factors as what car you own, how long you’ve been licensed, and how many miles you drive each year.

Changes Coming?

There’s a backlash brewing in New York against the use of nondriving insurance factors.

It began gathering steam in 2017 when the state’s Department of Financial Services imposed a new rule requiring companies to prove that using a driver’s job and education to set their premiums isn’t discriminatory. Within months, all of the major car insurers stopped using both factors in New York.

Last year the same regulator asked insurers some questions about how they’re using credit scores to set premiums. It asked them to show how risky it is to insure drivers with high, medium, and low credit scores, and whether they had analyzed the relation between credit score and income, a rating factor insurers aren’t allowed to use. The companies’ responses are confidential.

And this year the New York Assembly Majority Leader, Crystal Peoples-Stokes, reintroduced a bill she has backed since 2015 that would outlaw the use of any socioeconomic factors to determine premiums and coverage terms. The ban would cover credit score, age, sex, marriage status, sexual orientation, job, education, and other factors.

“Using socioeconomic and nondriving factors that are not inherently related to a person’s ability to operate a car safely forces good drivers who are of lower socioeconomic status to pay more for our state’s obligatory auto insurance,” Peoples-Stokes wrote in a memo describing the bill.

If passed, “this bill would make a significant impact on our clients,” says Neha Karambelkar, an attorney at the Western New York Law Center, a legal aid organization in Buffalo. “If credit scores were taken out of the equation, they would be able to access affordable auto insurance. That would have a far-reaching, tremendous impact on a lot of low-income and Black and Brown communities.”

Several other states are considering similar moves. In Nevada, a pandemic-related ban on rate increases based on credit is in place until 2024. New Jersey, Oregon, and Rhode Island are among the other states considering limits on how insurers can use credit information.

What You Can Do

If you live in a state where car insurers can use your credit score and ZIP code and you think that poor credit might be inflating your premiums, shop around. You might find a different insurer that weighs credit scores less heavily in its pricing algorithm.

Depending on where you live, you might be able to find an insurer that ignores credit scores altogether. CURE, a nonprofit insurer that serves drivers in New Jersey, Pennsylvania, and Michigan, doesn’t consider credit scores at all. Root, which is available in 34 states, says it will stop using credit scores by 2025.

You can also follow CR’s general advice for cutting your car insurance costs. One suggestion is to consider telematics programs that promise discounts for safe drivers who agree to install an app or a device that tracks their driving characteristics, like speeding and hard braking. But you should be aware of the privacy drawbacks and consider whether you’re willing to share your location and driving details with your insurer.

You can also take a close look at your credit report to make sure there aren’t any mistakes. Make sure you check all three major bureaus—Equifax, Experian, and TransUnion—because a mistake in one report doesn’t always show up in the others. Through the end of 2023, you’re entitled to one free report a week at annualcreditreport.com.