Electric Vehicles May Cost More to Insure Than Gasoline-Powered Cars

But prices are likely to come down as insurance companies gather more data on repair costs and EVs become more popular

Many different factors go into an insurer’s decision about how much to charge for a premium for any given car.

Among the big ones are biographical factors: where you live, your age, your driving experience, and—except for three states that outlaw it—your credit score. The type of car you’re insuring is also a key consideration. Insuring a high-powered sports car, for example, is going to cost more than insuring a sedan because owners of those cars often exhibit riskier behavior, like driving faster and more recklessly. Also, high-performance cars are more likely to be stolen. Similarly, high-end vehicles that are more expensive to fix and cars that are most vulnerable to theft cost more to insure because of the greater financial risk they present to insurance companies.

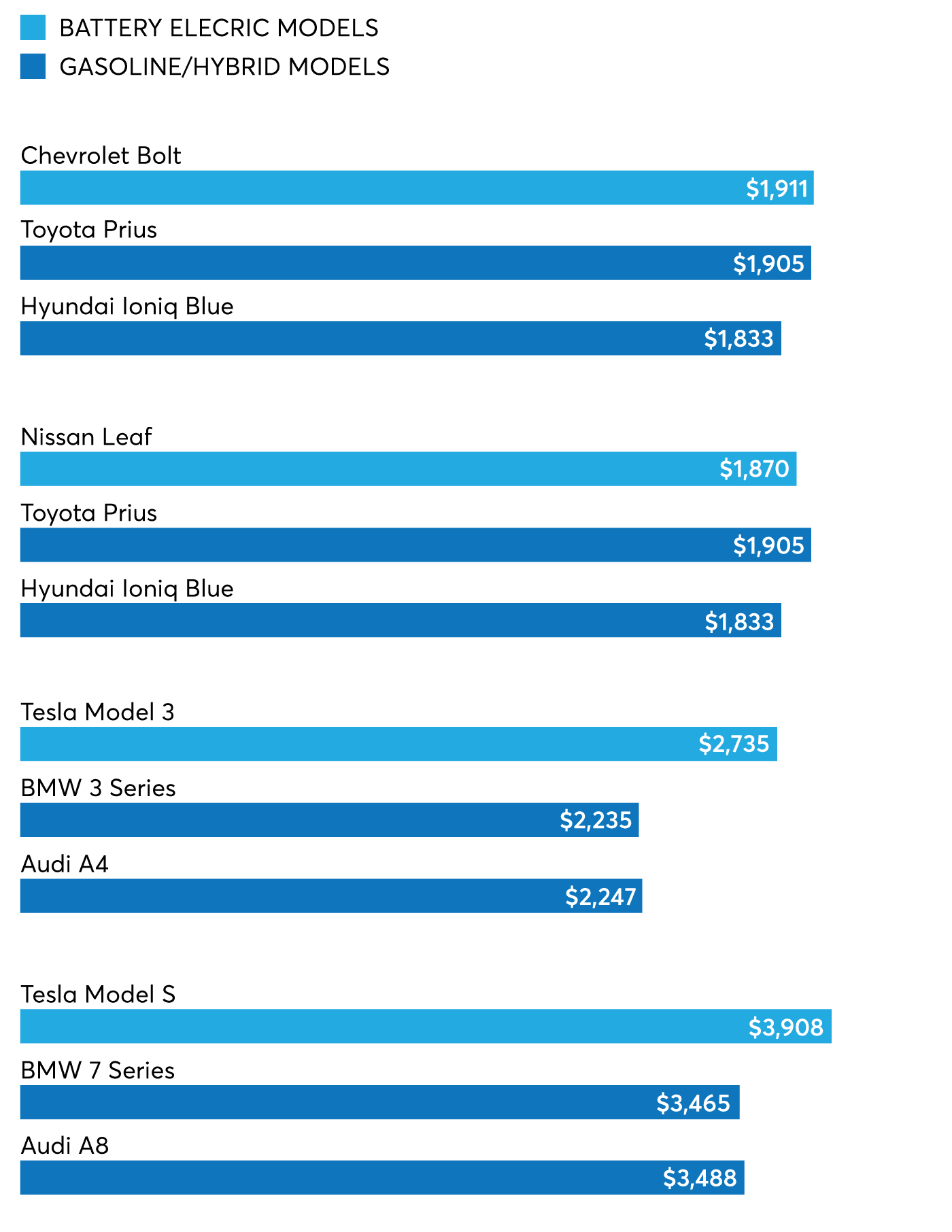

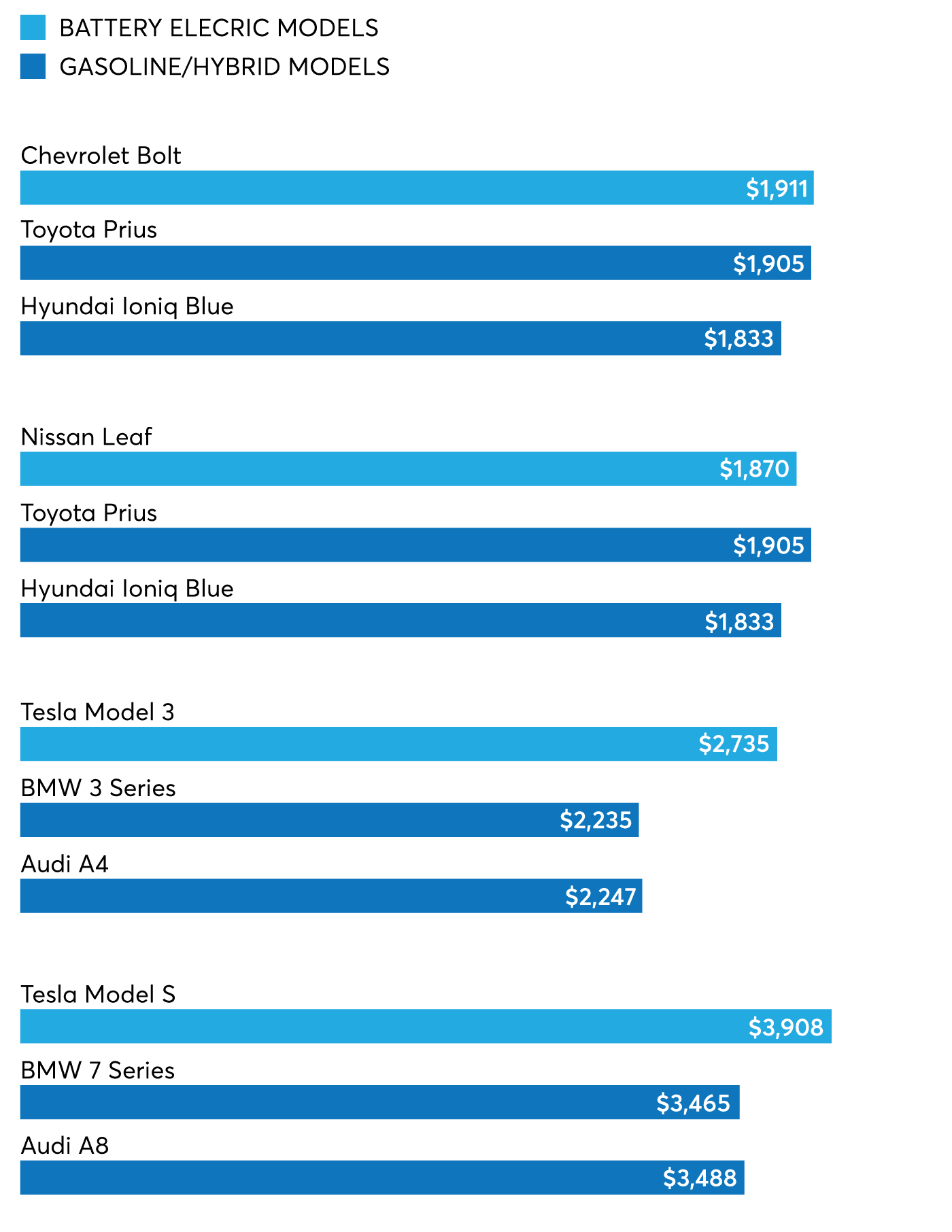

Electric vehicles, however, don’t yet fit neatly into the old framework. Though there are exceptions, utilitarian and high-end models cost more to insure than equivalent gasoline-powered cars, including hybrids. Lynne McChristian, director of the Office of Risk Management and Insurance Research at the University of Illinois, Urbana-Champaign, says that’s most likely because insurers don’t have as much longstanding risk assessment data for EVs as they do for other vehicles, and have to price uncertainty into their premiums.

CR shows you how to avoid overpaying for car insurance.

Fortunately for consumers, insurance premiums for EV models have been trending downward as insurance companies collect more data and more models come to the market, McChristian says. The share of electric vehicles on American roads, though growing, is still relatively small. According to the International Energy Agency, EV sales were strong in the first year of the pandemic and continued to rise through 2021 and 2022, even as new-car sales began to drop off due to supply chain problems and production delays. Also keep in mind that many manufacturers have announced plans to increase electric vehicle production, and several new electric models are scheduled to appear in the U.S. market over the next couple of years. More EVs on the roads means more data on them, which will enable insurers to have a better idea of how risky they are to insure. It’s also likely to bring down the cost of parts for repairs and broaden the availability of qualified repair technicians.

In the Market for an Electric Car?

Use CR’s Electric Vehicle Savings Finder to explore EV incentives and tax credits.

And remember, insurance isn’t the only cost associated with owning a car. A Consumer Reports’ study published in 2020 examined vehicle maintenance and repair costs over years of ownership and found that overall they were less for EVs than for equivalent gasoline-powered vehicles. Fueling costs—how much you’ll spend charging a car as opposed to putting in gasoline—are lower, too. As more EVs show up in driveways, they will probably cost less to build than they do now, which will translate into lower prices to buy.

Chris Harto, CR’s senior sustainability policy analyst, says that with EVs, it’s especially important to shop around for the best insurance because rates vary widely between insurers. “Some EVs may be slightly more expensive to insure right now, but the savings—for the planet and for your wallet in terms of reduced fuel and maintenance costs—outweigh that by far,” he says.

Than Gasoline Cars

*Figures are national averages based on an analysis of rate filing data from all U.S. states and Washington, D.C.